What Clinics Should Look For in a Patient Financing Partner

Choosing a patient financing partner is one of the most important decisions a clinic can make — especially for cosmetic, elective, and high-ticket treatments. The right partner can increase case acceptance, improve cash flow, and make the checkout experience smoother for both patients and staff.

But not all financing platforms operate the same way.

Some prioritize fast approvals. Others focus on lower fees. Some build for high-income borrowers, while others cater to a wider patient base.

This guide outlines the key factors your clinic should evaluate when comparing patient financing partners.

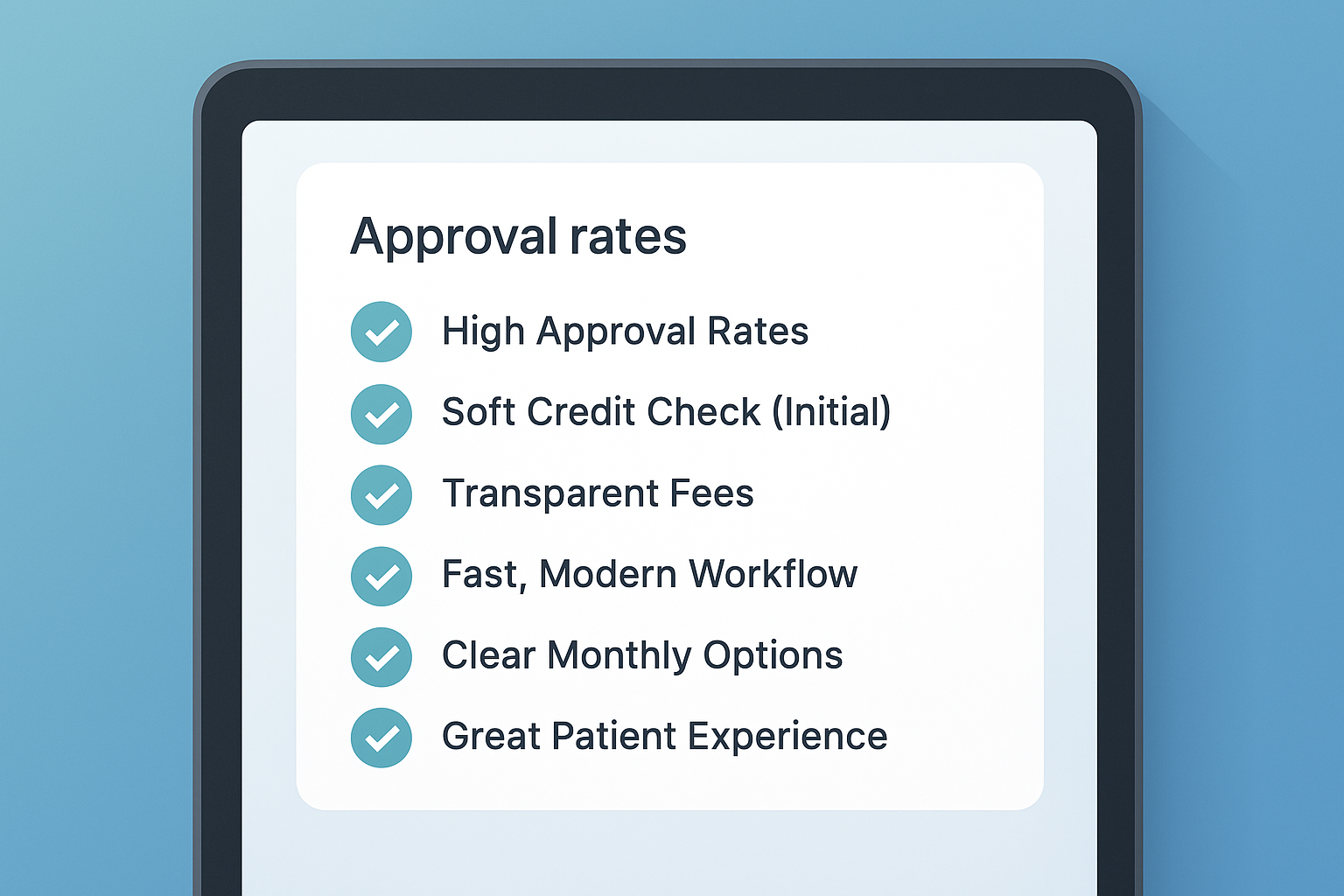

1. Approval rates that match your patient base

Approval rate is often the first metric clinics look at, and for good reason: if most patients are declined, your financing program isn’t working.

What matters most is alignment:

- Does the platform support your typical income range?

- Are approvals consistent for both small and large ticket sizes?

- Does it support cosmetic/elective procedures (not all lenders do)?

- Does the underwriting fit real-world patient profiles?

High approval rates matter — but quality approvals matter more: offers patients can actually say yes to.

2. A soft credit check for the initial application

Patients should feel safe applying for financing.

Look for a partner that uses:

- Soft pulls for the initial check

- Clear patient messaging around credit impact

- Fast, in-clinic prequalification

This reduces hesitation and increases application volume, which directly improves case acceptance.

If long-term loans require a hard credit check, the patient should be informed only at the moment they accept the final terms, not during the initial pre-check.

3. Transparent fee structure for clinics

Financing always involves a trade-off between:

- Cash flow

- Risk

- Convenience

- Approval coverage

But the fees should be:

- Clearly stated

- Predictable

- Easy to explain

- Free of hidden charges

A good financing partner acts like a payments partner — not a black box of unpredictable costs.

4. A fast, modern application experience

Patients expect the same level of convenience they get from e-commerce.

Your financing partner should offer:

- Application via QR code or text

- Simple, mobile-first forms

- Instant prequalification decisions

- Clear monthly payment options

If the process feels slow, outdated, or paperwork-heavy, patients lose momentum — and case acceptance drops.

5. Options that match different budgets

Strong financing partners offer range, not a single rigid product.

Look for:

- Short-term plans

- Longer-term installment options

- Multiple term lengths

- Flexible repayment schedules

Patients make decisions based on monthly comfort, not total cost.

More flexibility means more approvals — and more complete cases.

6. A neutral, non-pressure workflow for your team

Your staff should never feel like they’re “selling financing.”

They should feel like they’re offering options.

A strong financing partner provides:

- Clear scripts

- Easy explanation flows

- Tools that blend naturally into the consultation

- Simple handoff moments (QR code → patient applies privately)

The workflow should reduce, not increase, the emotional load on coordinators.

7. Seamless integration with your clinic operations

Financing should fit inside your day-to-day processes.

Key questions to ask:

- How easy is it for staff to access patient decisions?

- Is the dashboard simple and intuitive?

- Does it work during busy hours?

- Can it be used in consult rooms, operatories, and the front desk?

- Is there staff visibility on status and history?

Your team shouldn’t have to “force-fit” financing into the workflow — it should feel natural.

8. A great patient experience from start to finish

Patients judge financing partners the same way they judge clinics:

- Clear language

- Easy options

- No hidden terms

- Fast decisions

- Transparent repayment schedules

If the financing feels confusing or intimidating, it reflects poorly on your clinic — even if it’s not your fault.

Choose a partner that feels modern, trustworthy, and aligned with your brand.

9. Dedicated support for your clinic

Questions will come up — from your team and from patients.

A good financing partner offers:

- Fast support response times

- Training resources

- Clear documentation

- Real human support when needed

You’re not just choosing a tool.

You’re choosing a long-term operational partner.

10. A shared philosophy around patient trust

The best financing partners understand that clinics succeed when patients feel:

- Informed

- Respected

- Safe

- In control of their decisions

Look for a partner that prioritizes transparency, clarity, and a frictionless experience over short-term gains.

Patient trust isn’t optional — it’s the core of a growing clinic.

How Luma approaches this

Luma is designed around the needs of dental, cosmetic, and elective clinics:

- Soft credit checks for the initial application

- Fast, modern application workflow

- QR-code and mobile-first experience

- Transparent terms

- Options that fit a wide range of patient budgets

- Simple, intuitive dashboard for staff

- A patient experience that feels clean and welcoming

Our goal is simple:

Help clinics offer monthly payments confidently — and help patients access the care they want without unnecessary barriers.